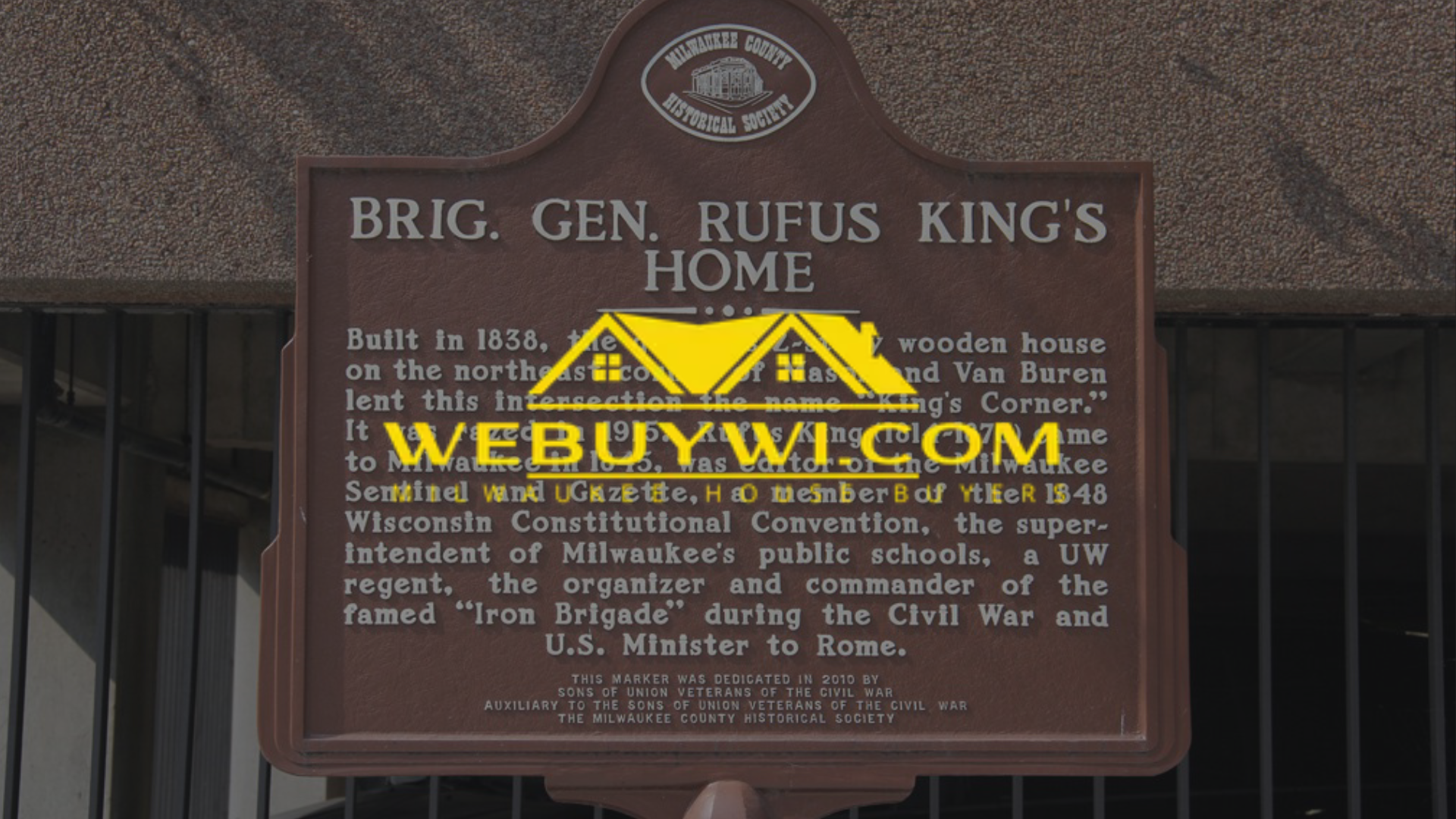

Sell Your House Fast Due to Fire Damage in Rufus King, Milwaukee

A devastating fire can transform your cherished home in Rufus King, Milwaukee, into a fire damaged house overnight, leaving you grappling with smoke residue, structural concerns, and the urgent need to rebuild your life. This neighborhood, with its blend of historic architecture and modern family living near Milwaukee's bustling core, deserves solutions that honor its community spirit.

At WeBuyWI, we help homeowners like you sell your house fast due to fire damage in Rufus King Milwaukee by offering a fair cash offer and buying as is—no repairs, no staging, just fast cash to ease the burden. Whether you're navigating an insurance claim or facing mounting holding costs, our cash buyers provide a streamlined selling path that outperforms traditional routes with real estate agents. In this extensive guide, we'll cover the fire damage aftermath, repair value considerations, and why a cash sale often leads to more money in your pocket, empowering you to choose the right price and deal for your situation.

The Devastating Impact of Fire on Rufus King Homes

Fire damage strikes without warning, often starting from electrical faults or unattended appliances in older Rufus King properties. The intense heat warps materials, while smoke infiltrates every corner, creating a toxic environment. For many sellers, this turns their dream home into a source of anxiety, prompting the need to sell directly rather than invest in the full extent of restoration.

Immediate Response: Calling the Fire Department

Your first instinct after a fire should be safety—evacuate and contact the fire department immediately. In Rufus King, Milwaukee Fire Department crews respond swiftly, containing the blaze and assessing initial estimates of damage. Their report becomes crucial for your insurance company, but it also highlights why delaying a sale can escalate repair costs.

Filing an Insurance Claim After Fire Damage

Once the scene is secure, reach out to your insurance company to initiate the claim process. Provide photos, fire department notes, and details of the incident. However, payouts often fall short of the repair value, especially for hidden smoke or water damage from firefighting efforts. This gap leaves many home sellers exploring faster alternatives like a cash sale.

Assessing the Full Extent of Fire Damage

A professional inspection reveals the true scope: charred framing, compromised roofing, and pervasive smoke odors. In Rufus King homes, where architectural details add character, fire can amplify vulnerabilities. Understanding this full extent helps you weigh selling as is against the daunting prospect of major repairs.

Smoke Damage: The Invisible Threat

Smoke doesn't just blacken surfaces—it seeps into HVAC systems, fabrics, and walls, causing long-term health issues and devaluing the property. Cleaning alone can cost thousands, deterring most buyers. For Rufus King residents, addressing smoke damage promptly is key, but cash investors often overlook these red flags in favor of a holistic purchase.

Water Damage from Firefighting Efforts

Fire suppression introduces massive water intrusion, leading to warped floors, mold growth, and weakened structures. In Milwaukee's humid climate, this compounds the issue within days. Home sellers facing both fire and water damage find traditional repairs overwhelming, making a buy houses as is approach from cash buyers even more appealing.

Estimating Repair Costs for a Fire Damaged Home

Initial estimates from contractors might range from $20,000 for minor smoke cleanup to over $100,000 for structural overhauls in a Rufus King fire damaged house. These figures eat into your equity, especially when holding costs like utilities and loans accrue monthly. Many sellers realize that investors typically pay closer to the home's market value minus these deductions.

Why Major Repairs Aren't Always Worth It

Undertaking major repairs demands upfront capital, time, and coordination—luxuries few have post-fire. In Rufus King, where labor costs are rising, the return on investment may not justify the effort. Selling to house flippers or cash buyers allows you to offload the property online-free and pocket proceeds without the headache.

Holding Costs: The Hidden Drain After Fire

While you deliberate, holding costs mount: mortgage payments, property taxes, and insurance premiums continue unabated. For a fire damaged property in Rufus King, these can add $1,000+ monthly, eroding potential profits. A fast sale mitigates this, providing immediate relief and more money for relocation.

The Traditional Selling Path with a Real Estate Agent

Listing with a real estate agent involves marketing the fire damaged home to attract potential buyers, but disclosures about damage scare off many. In Rufus King’s competitive market, agents push for cosmetic fixes to boost appeal, delaying your timeline and inflating costs.

Challenges of Working with a Listing Agent

A listing agent or own agent excels at staging and negotiations, but for fire damaged properties, they often recommend repairs to secure the right price. This extends the selling process, with offer accepted dates pushed back by inspections. Partner agent networks can help, but commissions still apply.

Realtor Commissions: A Costly Trade-Off

Realtor commissions, typically 5-6% of the sale price, can shave $15,000 off a $250,000 Rufus King home. Add closing costs like appraisals and staging, and your net drops further. Cash sales eliminate these, letting you keep more from the deal.

Attracting Potential Buyers in a Tough Market

Most buyers seek turnkey homes, viewing fire damaged houses as risky investments. In Rufus King, where demand for intact properties outpaces supply, your listing might languish, leading to price reductions. Cash buyers, however, specialize in that homes needing work, offering a quicker path.

Red Flags That Deter Traditional Buyers

Disclosures about fire damage raise red flags: liability concerns, lingering odors, and unknown structural issues. Traditional buyers demand concessions or walk away, prolonging the hassle. Selling as is to cash investors sidesteps this, focusing on a straightforward transaction.

How Fire Damage Affects Your Home's Market Value

Fire slashes market value by 20-50%, depending on severity—appraisers factor in repair costs and stigma. For Rufus King properties, baseline values around $200,000-$300,000 plummet post-fire. A fair cash offer from WeBuyWI accounts for this realistically, often netting more after traditional fees.

Selling As Is: Embracing the Imperfect

Opting to sell as is means no need for cleaning, painting, or structural fixes—transfer the property in its current state. This appeals to house flippers and cash investors who see profit in renovations. In Rufus King, it's a pragmatic choice for sellers prioritizing speed over perfection.

The Appeal of a Cash Sale for Fire Damaged Properties

A cash sale closes in days, not months, providing fast cash without buyer financing contingencies. No showings, no negotiations—just a firm offer and done. For Rufus King home sellers, this means escaping the emotional toll of open houses in a damaged space.

Who Are Cash Buyers and Why Choose Them?

Cash buyers are real estate investors or firms like WeBuyWI that pay cash for distressed properties, handling everything from title company coordination to cleanup. They thrive in select markets like Milwaukee, buying fire damaged homes that traditional buyers avoid, ensuring a successful sale.

How Cash Investors Evaluate Fire Damaged Houses

Cash investors assess via photos and walkthroughs, calculating after-repair value minus their costs. In Rufus King, we consider neighborhood comps and fire specifics, delivering a transparent offer. Unlike auctions, we pay cash upfront, avoiding the uncertainty of bidding wars.

Securing a Fair Cash Offer from WeBuyWI

Contact us with basic details, and we'll provide a free, no-obligation fair cash offer within 24 hours. Based on current home conditions and Rufus King market trends, it's competitive—often 70-85% of repair value, minus what you'd lose to agent fees and delays.

The Entire Process: From Offer to Closing

Our process is simple: review the offer, accept if it fits, then we coordinate with your real estate attorney if needed. A title company handles paperwork, and we set a closing date—typically 7-14 days. No surprises, just a smooth handoff for your fire damaged property.

Flexible Closing Dates Tailored to You

Choose your closing date to align with insurance payouts or relocation needs. Cash sales offer this flexibility, unlike rigid traditional timelines. In Rufus King, where life moves fast, this control lets you focus on healing rather than logistics.

Skipping Closing Costs in Cash Transactions

Traditional sales tack on 2-5% in closing costs—title fees, escrow, and more. WeBuyWI covers these, plus any real estate attorney consults, ensuring you walk with maximum proceeds. This is crucial when fire recovery strains finances.

Alternatives Like HomeLight Simple Sale

Platforms like HomeLight Simple Sale connect you to investors for quick offers, but they may route through agents, adding fees. WeBuyWI cuts the middleman, providing direct cash without the markup, ideal for Rufus King sellers seeking pure efficiency.

House Flippers: Allies or Competitors?

House flippers buy low to renovate and resell, often at a discount. While they move fast, their offers prioritize profit margins. Professional cash buyers like us balance fairness with speed, giving you more money without the lowball pressure.

Real Stories of Successful Sales in Rufus King

Verified reviews from Rufus King sellers praise our approach: "After the fire, WeBuyWI bought our home as is in a week—saved us from repairs and got us fast cash." These tales highlight how many sellers turn crisis into opportunity with our help.

Why Sell Your Home Fast in Rufus King's Market

Rufus King's market favors quick-turn properties, but fire damage shifts dynamics. Selling fast preserves value against depreciation and avoids seasonal slumps. With rising demand for investor buys, now's the time to leverage a cash deal for the best outcome.

Coordinating with a Title Company for Security

A reputable title company ensures clear title, free of liens from the fire incident. We partner with locals in Milwaukee to expedite this, protecting both parties. It's a seamless step in our commitment to a worry-free sale.

Conclusion

In Rufus King, Milwaukee, fire damage doesn't have to derail your future. We've unpacked the realities—from the fire department's role and insurance claim hurdles to the pitfalls of real estate agents and the freedom of selling as is. At WeBuyWI, our cash buyers deliver a fair cash offer that outshines traditional paths, saving you from repair costs, realtor commissions, and endless showings.

Picture this: Instead of pouring money into a fire damaged house that most buyers won't touch, sell directly to us for fast cash and a closing date on your terms. Whether smoke lingers or water damage complicates things, we buy houses in any state, turning potential losses into solid gains. Our transparent process, backed by verified reviews, ensures you get more money without the hassle.

Don't let holding costs or market fluctuations hold you back. Contact WeBuyWI today for your free cash offer—no strings, just honest value based on your property's true worth. In the heart of Rufus King, where resilience defines the community, let's make your next chapter brighter. Sell your home fast, reclaim your peace, and move toward that dream home waiting just ahead.